The two words that just go together -- like Fear and Loathing.

And in today's episode of GOP Mailing Melodrama, the National Republican Congressional Comittee brings all four.

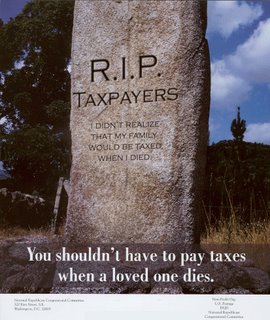

Of course the mailer in question also features low-budget cheesiness that we have come to expect from the NRCC's 6th District correspondence. First, there is pathos via clip art:

But it is somewhat unclear whether the woman in the clip art is trying to stifle her grief, her laughter or her vomit. Perhaps she witnessed something "just disgusting"...

And there is the now familiar odd-ball death imagery:

But there is no explanation why a multi-millionare -- the tax in question only applies to estates in excess of two million dollars -- would have such a battered headstone. And there are no clues as to why the deceased multi-millionare's family -- who, regardless of the size of the estate, inherit the first two million dollars tax-free -- didn't insist that the writing on the gravestone be written in parallel lines.

No one in my family will ever trigger the millionares' estate tax, but I would never EVER stand for such a shoddy headstone.

And there is the obvious question: Is this grave the home of the goofy ghost from the earlier mailer? The voters of the 6th District want answers!

But what about the substance of the mailer? Just as goofy.

"You shouldn't have to pay taxes when a loved one dies"? Okay, you don't have to.

All you have to do to avoid paying taxes "when a loved one dies" is not accept an inheritance from an estate of more than two million dollars. Not only is not inheriting millions my plan for avoiding the estate tax, everyone I know is going to avoid it that way.

And because the tax only applies to multi-million dollar estates -- less than 3 percent of deceased adults in 2002 had estates subject to the tax-- I'll bet that you and almost everyone you know will avoid the estate tax in exactly the same way.

And what about the claim that the multi-millionares' estate tax puts family farms and small business owers at risk?

The truth is that very few actually pay the estate tax.

The Tax Policy Center reports that in 2004, in all of the United States of America, roughly 440 taxable estates were primarily farm and business assets. And even considering estates in which farming or business was a sideline, the Center found only 7,090 taxable estates for 2004 that included any farm or business income. The estate tax repeal benefits primarily non-farmers and non-business-owners. People like the fellow pictured on the right:

And these hard workers:

But what about the mailer's claim that Democrat Major Tammy Duckworth just can't wait to spend your hard earned money?

Eric Krol of your Daily Herald reports that Maj. Duckworth has vowed to cut Congressional spending by ending the wasteful and corrupt practice of "earmarking" pork projects in Washingon. By contrast

Well, that sure ain't gonna slow Congressional spending.Republican congressional hopeful Peter Roskam, who’s always billed himself as a fiscal conservative, tried to walk a political tightrope Monday by embracing an oft-criticized budget tactic for securing federal funding for local projects. The 6th Congressional District GOP nominee said he’d support continuing the so-called practice of “earmarks” if elected to Congress[.]

So, in conclusion, here are two pieces of free advice.

First, to the NRCC: While it is okay to use cut and paste graphics with no connection to the 6th District in your mailings, you should not use cut and paste arguments about rampant Congressional spending when 1) your party controls Congress, and 2) your candidate has embraced pork barrel spending.

Second, to Republican readers: Please, please, please donate to the National Republican Congressional Committee. No, really. If you're a Republican and have only one dollar to contribute to the election in November, please send that dollar to the NRCC. Nothing would make my Democratic heart happier than to see GOP campaign dollars directed to the masterminds behind these mailings. So Republicans, please give to the NRCC, and give often.

In fact, you Democratic voters might want to contribute to the NRCC trainwreck as well.

1 comment:

"you shouldn't have to pay taxes when a loved one dies"

...and statistically, you won't!

Post a Comment